Medical Devices 101 // Dental Implants

DATE

October 12, 2020

AUTHOR

Benjamin Sauer | VP Engineering

What are dental implants?

Tooth loss is an increasingly common problem around the world which can be caused by oral disease, a lack of oral hygiene, a poor diet, or accidents. Dental implants, i.e. replacement tooth roots, are used to support dental prosthetics or false teeth in a patient’s mouth. These medical devices provide a strong foundation for permanent or removable replacement teeth and are made to match a patient’s natural teeth.

According to Grand View Research, the global dental implant market was valued at US$ 4.6 billion in 2019 and is expected to grow at a CAGR of 9% over the next seven years. Given their many advantages, such as durability, relative safety, effectiveness, and naturally appearing teeth, demand for dental implants is likely to keep increasing in the future. The market is further driven by “growing awareness about oral care, a surge in the global economies and per capita healthcare spending, and a rise in the importance of aesthetic restoration of dental implants”.

However, with the COVID-19 pandemic, the dental industry – like many others – has suffered some major setbacks and the impact will be felt for years to come. Broadly speaking, we can expect a decrease in dental services as elective procedures are delayed and other, more urgent cases are prioritized.

As relatively high-risk class devices, dental implants are typically classified as IIb. In the following, we will discuss different aspects of dental implants and what manufacturers need to be aware of under EU MDR law.

How are dental implants inserted?

During dental implant surgery, the oral surgeon will make a cut to open the patient’s gum and expose the bone. Holes are then drilled into the bone where the dental implant metal post is to be placed. As the post will serve as the tooth root, it is implanted deep into the bone. At this stage, the patient will still have a gap where their tooth is missing, so a type of partial, temporary denture can be placed for appearance. This denture can be removed for cleaning and while sleeping. Following surgery, the patient may experience some typical discomforts associated with most dental procedures, such as swelling, bruising, pain or bleeding. Therefore, they may require pain medication or antibiotics after dental implant surgery.

What dental implant types are there?

In modern dentistry, there are over 100 different implant systems which dentists and patients can choose from. These systems for dental implants differ both in shape and material. For patients, criteria such as durability, inflammation risk and cost are usually the most important. Most of the approved implant systems come from implant manufacturers in Germany, France, Israel, Korea, Switzerland, Sweden and the USA. They differ mainly in their implant shape, the material used, the surface and size. These properties, in turn, have an impact on the implant’s cost.

A main distinction is whether the implant consists of one or two pieces. One-piece implants offer advantages such as lower production costs and higher fracture resistance compared with two-piece implants. With the two-piece implant system, there is both an implant body – which is inserted directly into the jawbone – and the “abutment”, the visible part on which the denture is placed. With the one-piece implant system, the abutment is already manufactured into the implant body.

What’s the new process for certifying and monitoring dental implants under EU MDR?

Although the European Union Medical Device Regulation 2017/745 (EU MDR) states that implantable medical devices and Class III medical devices will be defined as higher risk class devices and should be subject to specific safety and performance requirements, dental implants are actually exempt from this rule. Clause 3 in Article 18 of the EU MDR specifies:

The following implants shall be exempted from the obligations laid down in this Article: sutures, staples, dental fillings, dental braces, tooth crowns, screws, wedges, plates, wires, pins, clips and connectors. The Commission is empowered to adopt delegated acts in accordance with Article 115 to amend this list by adding other types of implants to it or by removing implants therefrom.

As class IIb medical devices, which make up about 8% of the medical device market share (source: Johner Institut), dental implants are nonetheless subject to several important legal requirements. In the following, we will look at what changes can be expected with the EU MDR compared to the MDD (Medical Device Directive) which it will replace.

Conformity Assessment

According to the MDR, the Conformity Assessment describes a procedure which determines whether or not a medical device complies with the requirements in the MDR. The Conformity Assessment of medical devices for CE marking (Chapter V Section 2) varies according to the device’s risk class and specific features of certain devices (Article 52). For dental implants as class IIb devices, implant manufacturers must either have a full Quality Management System (QMS) in place that is compliant with ISO 13485 or Annex IX OR they must follow Annex XI.

Furthermore, a type examination is required for dental implants as described in Annex X (if not Annex IX is followed). This type examination is meant to show that the implant manufacturer is, in fact, developing a medical product. Before producing and selling the dental implant, the manufacturer’s Notified Body will verify the implant’s conformity with the general safety and performance requirements. One challenge here is that there is currently a shortage of MDR-certified Notified Bodies in the EU and that many major Notified Bodies have only just become licensed as MDR compliant and are now dealing with a mass influx of MDR applications. Manufacturers should therefore plan for delays in this respect.

Post-Market Surveillance

While the MDD focused strongly on the pre-market phase of medical devices, the EU MDR’s aim is to ensure devices’ performance and safety throughout their entire lifecycle, including once they are being applied on the market. The reason is that certain risks do not become apparent until a device is already being used by a doctor to treat a patient. Therefore, in addition to minimizing the risks posed by dental implants and ensuring their safety before they are placed on the market (through Conformity Assessment with a Notified Body), manufacturers must continue to monitor their dental implants and collect data on them after they’ve been taken to market.

This is where Post-Market Surveillance (PMS) comes in. Its aim is to systematically identify these risks in the practical use of the product, to verify the performance of the products “in the field”, to find product defects and undetected security problems, to continuously update the benefit-risk assessment and to quickly initiate any necessary measures such as product callbacks in the case of adverse events. The responsibility of PMS lies with the dental implant manufacturer, but they can oblige dealers of their products to provide data for PMS as well. As an example, the retailer is usually also a medical device consultant, who is required to provide information to the manufacturer on the products’ safety.

Navigating Post-Market Surveillance in the EU MDR Era

Proactive and reactive PMS

There are two types of PMS: Proactive and reactive. Reactive PMS, also known as “Vigilance”, means responding after an incident has occurred, e.g. a complaint or serious injury or in extreme cases even a death of a patient due to the dental implant. Some of the risks associated with dental implants include infection, excessive bone loss, perforation during surgery, implant breakage or fracture or nerve damage. Since reactive PMS usually involves data collection, it is considered a “passive” activity.

Proactive PMS, on the other hand, is about anticipating or preventing a serious incident before it has happened. This can take place in the form of surveys among end users (in this case, the dentist or oral surgeon), implant registries, specialist groups or Post-Market Clinical Follow-up studies. The goal is to gain data about the implant’s real-world performance. Analysing and reviewing the data is part of the risk management process and needs to be conducted on a routine basis.

| Reactive PMS | Proactive PMS |

|

|

Source: Effective post-market surveillance by BSI

Clinical Evaluation Report

In preparation for the EU MDR, dental implant manufacturers must also assess their Clinical Evaluation Reports (CER) for all implants with a CE marking. In this regard, they should cross-check equivalent device data used in previous literature reviews to ensure they meet the more stringent definition of “equivalence” under EU MDR law. The CER must be updated at regular intervals, with the frequency defined and justified for each dental implant category, if there is more than one. This report must be updated when new PMS data could affect the CER conclusion. And in the case of dental implants as a high-risk device, updates are required on a yearly basis.

Article 61, Clause 11

The clinical evaluation and its documentation shall be updated throughout the lifecycle of the device concerned with clinical data obtained from the implementation of the manufacturer’s PMCF plan in accordance with Part B of Annex XIV and the post-market surveillance plan referred to in Article 84.

Periodic Update Safety Report

For dental implants, a Periodic Safety Update Report (PSUR) is required when and as needed, and at least every year. The PSUR must also be delivered to the authority (upon request) and the appointed body. It is not, however, mandatory to submit it to the EUDAMED database. A PSUR should follow this structure:

- Meta information including references

- Plan implementation

- Product data (including sales, indications, patients)

- Overview of data (including adverse events)

- Results of analysis (including trends)

- Overview of actions taken (including CAPA, vigilance, FSCA)

- Conclusions from the risk-benefit ratio

- Final assessment

Source: Johner Institut.

Post-Market Clinical Follow-up

Finally, Post-Market Clinical Follow-up (PMCF) is part of PMS and is a continuous and mandatory process for collecting clinical data on a dental implant in the context of its intended use. PMCF’s aim is to continuously confirm the safety and clinical performance of the dental implant. The data gathered on an implant in the market serves to demonstrate that its identified risks remain acceptable in the context of its clinical benefit. There are several methods for conducting PMCF, and the suitability of each method depends on factors such as the general availability of clinical data for the implant, its risk class (IIb) and the dental implant market situation. PMCF can consist of data gathered from the vigilance system, complaints, technical information and publicly available information, and does not refer to PMCF studies alone. One useful PMCF method for collecting clinical data on dental implants is the use of surveys which we’ll discuss in the next section.

Data collection – time to take it digital

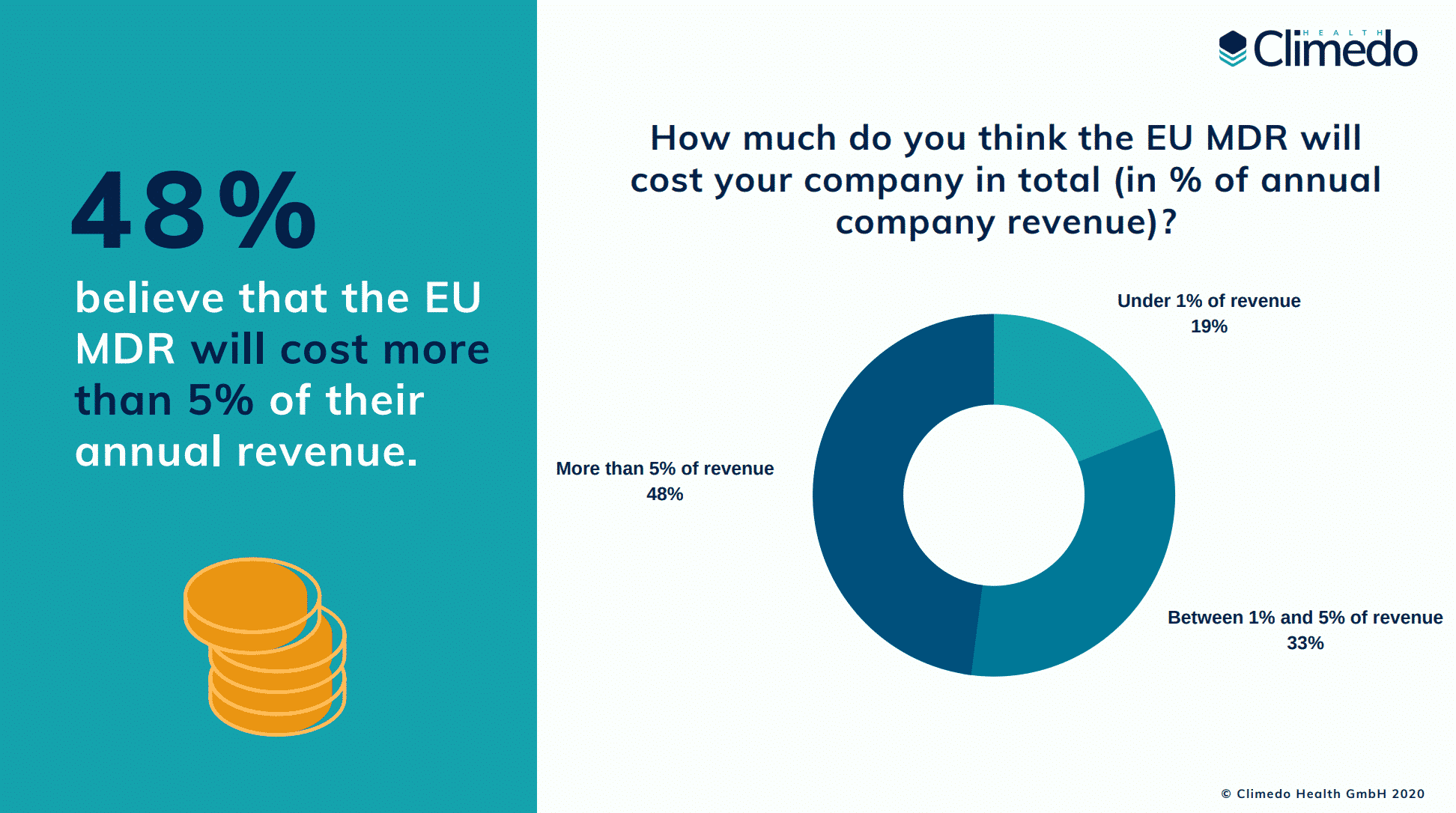

In a recent survey about the true costs of the EU MDR, we found that the new regulation requires a significant amount of resources on the part of manufacturers, particularly those selling high-risk devices:

- 55% of participants invest more than 5 additional hours per week in meeting the new MDR requirements

- 67% have hired or plan to hire at least one new employee to help cope with MDR

- Most time is spent on “understanding the new requirements” (cited by 68%), followed by “clinical evaluations and clinical studies” (63%)

- Most money is spent on clinical evaluation and clinical studies (cited by 75%), followed by PMS and PMCF activities (52%)

- 48% believe that the EU MDR will cost more than 5% of their annual turnover (in the Climedo survey from the spring it was only 32%)

We also asked some specific questions about clinical data capture and how survey participants were currently managing their PMCF studies. Here, we found that just 11% use an EDC solution for their clinical data collection activities, 69% use Excel and 47% use paper. 45% spend more than one hour per week on stakeholder communication. And more than half (51%) have not yet automated any part of their PMCF processes.

Survey results: The true cost of the EU MDR

So clearly, the results showed us that a particularly large amount of time and money is being invested into clinical studies and PMS activities. And this is exactly where manufacturers could be exploiting the power of digital, cloud-based solutions. Paper-based systems, which are still being used by half of the participants, will not be able to keep up in the future due to the strict regulatory requirements for data collection. We believe that an EDC solution is one of the few ways to save time and money, and ensure that medical devices are (re-)certified according to MDR and do not have to be taken off the market.

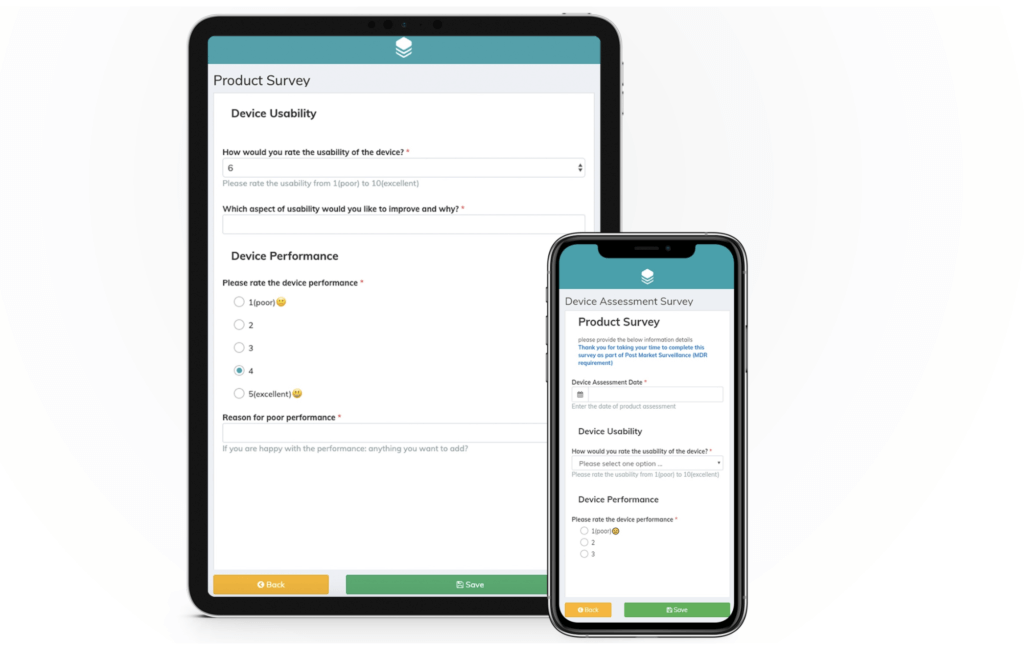

EDC solutions allow manufacturers to collect data on their dental implants in real-time. For example, QR codes can be printed on the device packaging for dentists and oral surgeons to easily scan with their mobile device. Once they have completed the survey – which can be done at their discretion anytime and anywhere, the results are available to the implant manufacturer’s dashboard immediately. The alternative that many companies still work with is the paper questionnaire. We do not need to explain at great lengths why paper-based solutions are much more tedious – not only are they less safe (paper forms are easily lost); they need to be posted back and forth, the handwriting is often hard to read and they cause huge delays which results in higher costs. If they are not completed, the manufacturer needs to follow up with the dentist while, with an EDC solution, they can schedule automated reminders to go out to the device users.

Want to learn how your company could save time and money with an EDC solution? Get a free trial:

Survey example for permanent / removable dental implants

If you’d like to see a survey example for dental implants in action, take a look at this PMCF survey which was created with Climedo’s software.

Dental implants example survey

Alternatively, scan this QR code with your smartphone to access the survey:

Case Study: BEGO Implant Systems

In 2020, we organized a two-day workshop with BEGO Implant Systems and several leading German dentists and implantologists to elaborate a Clinical Survey plan for BEGO Implant Systems. Our goal was to create a strategy for structured and EU MDR-compliant data capture as part of the company’s PMS and PMCF activities, and to identify ways to make the feedback process faster and more convenient.

Without exception, all dentists and implantologists in the workshop expressed their willingness to participate in the planned clinical survey using Climedo. Dr. Nina Wilkens, clinical affairs manager, BEGO Implant Systems, said: “The participating doctors were convinced by the Climedo system and we are looking forward to using it for our post-market surveillance activities. What we particularly like are the ease of use and the flexible options for configuring the clinical surveys. We can make any changes to the input masks ourselves in a very short time, without any necessary support from IT.”